Streaming services and OTT: navigating through consumer choices

Jan 15th, 2020

Written by Ampersand Marketing

We know there’s an influx of premium video services. We know content is king. What most don’t know is how consumers are making choices in selecting streaming services and what their limits are in subscribing to a multitude of services. Learn how audiences are navigating the video landscape, the key differentiators between the evolving TV platforms and the major streaming services today, and what that implies for the future of TV advertising.

VIDEO LANDSCAPE

The video landscape is crowded…very crowded. According to the research firm Parks Associates, there are 271 online video services available in the United States. Netflix and Amazon remain the largest players in the Subscription Video On Demand (SVOD) space, but that could change.

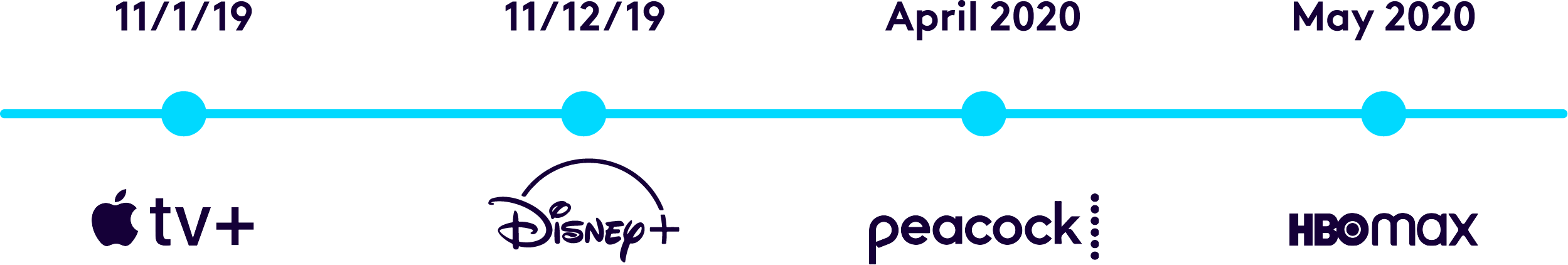

In a span of seven months, Apple TV+ launched and on its heels, the biggest traditional media companies are entering the space.

In an increasingly overcrowded space, not all will survive. PlayStation Vue will exit the vMVPD market on January 30, 2020 due to the high cost of programming. With supply comes choice and consumers no longer have to stay with a specific provider. Over 40% only subscribe for a short time. As the ecosystem becomes more competitive, more will likely fold.

SO MANY CHOICES, SO LITTLE TIME

With the plethora of streaming choices available, consumers face subscription fatigue as they try to manage what services to add, keep or cut. A Market Watch survey shows that the majority of households are willing to pay for 1-2 services. It begs the question, when will the marketplace hit a saturation point? According to a recent PwC report, nearly 2/3 of respondents who intend to subscribe to a new streaming service say they will downgrade or terminate one of their current subscriptions to do so.

TELEVISION IS STILL KING

There is no denying the landscape is changing. But, according to Nielsen’s Total Audience Report, people still watch TV. 96% of homes in the US have at least one TV. On average an adult spends 5 hours 23 minutes each day watching video, 75% of that time is spent watching Live or Time shifted TV.

Even with all the noise, as of September 2019, traditional cable via a line or satellite to the home still accounts for 72% of distribution into TV households and vMVPD (virtual providers) account for 6% of TV households. The majority of Americans recognize that pay TV still fulfills a need in their video portfolio and want to turn to traditional networks for their entertainment and news. OTT/SVOD services are supplemental entertainment to the primary content people consume.

FUTURE IMPLICATIONS

As more and more content becomes available, via traditional networks or SVOD, the perception is that consumers will continue to follow the content they want to see. But according to the Kagan’s US Consumer Insights survey, 58% say they Disagree or Strongly Disagree that they will subscribe to a new online service regardless of cost. A study done by Fluent suggests nearly 50% of consumers are frustrated by the growing number of subscription services required to see the content they want to watch. Perhaps indicative of streaming fatigue is the lull in cord-cutting. In the same PwC report referenced earlier, total pay-TV subscribers remained constant at 68% whereas cord-cutters saw a YOY decline for the first time in five years.

Finding audiences as they move between providers and content can be challenging. Ampersand, an aggregator of the ad-supported platforms for both MVPD and vMVPD, simplifies the path to finding audiences.

Ampersand reaches audiences at scale across TV platforms in 85 million households, over 120 networks across multiscreen delivery in all 210 local DMAs.

Ad-supported TV viewing is not going anywhere anytime soon. While consumers may move between providers there is still a demand for the content that is only found on MVPDs and vMVPDs.

JUMP TO THE FACTS

Disney+ Apple TV+ Peacock HBO MAX

JUST THE FACTS

The latest addition to the increasingly crowded streaming service space is Disney+, which launched on Tuesday, November 12, 2019.

- Despite some initial glitches and service outages, Disney+ had more than 10 million registrations on day one

- Disney+ initial cost is $6.99 per month or $70 per year (pre-paid)

- Bundle with Hulu (ad supported) and ESPN Plus for $13 per month

- Disney also made a deal with Verizon to give the carrier’s unlimited wireless customers a free year of Disney+

- Disney+ is available on most connected TVs, streaming media players and game consoles. It is also available on mobile devices through Apple’s App store or Google Play.

- Disney+ library consists of nearly 500 films and 7,500 episodes of television

CONTENT

Disney+ gives customers access to a vast library of Disney’s and Fox’s legacy content as well as new, exclusive TV shows, movies, documentaries and shorts. Disney+ is the exclusive home to stream blockbusters from Star Wars, Marvel, Pixar and classic Disney movies like Bambi, Cinderella, Toy Story, Lion King and Who Framed Roger Rabbit?

With Disney’s recent acquisition of Fox, Disney+ will have access to all 30 seasons of “The Simpsons.” The most anticipated original program is the big-budget Star Wars spinoff The Mandalorian. Other new original programs include all new Lizzie McGuire, The World According to Jeff Goldblum and Muppets Now.

Disney+ has a built-in audience with families with children and hard-core Disney, Star Wars, Marvel and Pixar fans. However, in today’s highly competitive environment, non-ad supported platforms must come up with more standout original content to lure potential subscribers and grow their base.

LANDSCAPE

While there isn’t a shortage of OTT choices, there is certainly a shortage of time to consume all the content available.

However, according to an eMarketer survey conducted earlier this year, over 50% of households that subscribe to Hulu and Netflix are Somewhat or Very Likely to subscribe to Disney+.

As more streaming services emerge, it remains to be seen how many subscriptions consumers will maintain.

FUTURE PROJECTIONS

Disney projects Disney+ will grow to 60 million to 90 million subscribers worldwide by fiscal year 2024. Morgan Stanley projected that number to be even higher at 130 million subscribers worldwide.

S&P Global estimates that Disney will “spend about 37.7% of its total budget this year on originals with the remainder allocated to acquisitions, mainly from its own library. Going forward, [they] expect expenditures could grow at a quicker rate for originals, accounting for 49.9% in 2023.”

As Disney grows their library of original content and exclusive programming, the price for subscriptions will likely increase.

JUST THE FACTS

Apple TV+, the SVOD service of Apple Inc., launched on Friday, November 1, 2019.

- Apple TV+ has a 7-day free trial, then is $4.99 per month

- Apple is also offering a one year’s subscription to Apple TV+ free, when buying an Apple product

- Customers have the ability to share between six family members

- The Apple TV app is available on select Samsung smart TVs, and will come to Amazon Fire TV, LG, Roku, Sony and VIZIO platforms in the future

- Apple TV+ library consists of eight original series and one original documentary with plans to release new content every month. Reportedly spending $6 billion on content for eventually 34 original series and 5 movies once everything is rolled out.

CONTENT

Apple TV+ is concentrated on only original programming with some of the biggest names. Jennifer Anniston and Reese Witherspoon join Steve Carell in The Morning Show. Hailee Steinfeld stars as Emily Dickinson in a comedy titled Dickinson.

Other titles that have been buzzworthy are For All Mankind, already renewed for a second season, which follows the race to the moon. On November 20, it was announced that they were pulling a screening of the film The Banker starring Samuel L. Jackson and Anthony Mackie due to some concerns surrounding the film.

The original documentary at launch is The Elephant Queen, which follows an elephant herd across Africa.

LANDSCAPE

A provider only gets one shot at a first impression and while there are some big names and high-quality production there isn’t a huge list of shows that consumers are paying extra for. Apple TV+ is the least expensive SVOD option available at the moment. But with so many ways to subscribe to the channel for free, once those opportunities run out will consumers be willing to pay for so little content?

FUTURE PROJECTIONS

Recent reports say that Apple TV+ is in production talks with HBO to produce original programming.

According to a CNBC report Apple TV+ is expected to have 136 million paid subscribers by 2025 in over 100 countries.

JUST THE FACTS

NBCU’s Peacock will launch April 2020

- Hit programs from the NBC vault as well as blockbuster films from Universal, Focus Features, Dreamworks Animation among others

- 15,000 hours of content

- Service will be both ad supported with a paid, ad-free option

- No additional charge to cable subscribers and Comcast broadband users, though there are rumors NBCU may make the ad-supported version of the service available to everyone at no cost

- Pricing will be announced closer to the launch

- 2020 Olympics is expected to play a major role in promoting Peacock, with many of the original series set to launch after the Games

CONTENT

Peacock will be home to comedy classics like The Office, Parks & Recreation, 30 Rock, Cheers, and Will & Grace and all 44 seasons of Saturday Night Live.

Original content includes a reboot of Battlestar Galactica, Saved By The Bell and Punky Brewster. Also, in store are a new Saturday Night Live docuseries “Who Wrote That” and an original talk show series with Jimmy Fallon. There is speculation of a reboot of The Office, but likely without the entire original cast. Peacock will be home to Brave New World starring Demi Moore and Dr. Death with Alec Baldwin and Christian Slater.

Library of classic movies like Back to the Future, ET, Despicable Me, Field of Dreams, Jaws and the Fast & The Furious franchise.

JUST THE FACTS

In May 2020, AT&T’s WarnerMedia will launch HBO Max, its direct-to-consumer video service

- Offers all of WarnerMedia’s assets, including Warner Brothers, the CW, CNN, TBS, TNT, TruTV and anchored by HBO

- 10,000 hours of content

- By 2021, HBO Max plans to have 50 original titles. New shows will roll out weekly instead of releasing the entire season at once

- $14.99 per month

- Separate interface from HBO Go (digital on demand service for authenticated cable subscribers) and HBO Now (standalone online version)

- Direct billed subscribers of HBO Now will get access to HBO Max for no additional charge

- Goal of 50 million total HBO subscribers by 2025

- TBD if HBO Max will stream video in 4K, but may need to in order to be competitive with other streaming services

- Possible ad-supported tier of HBO Max in 2021

- Expect subscription prices to increase after introductory period

CONTENT

HBO Max will be home to every episode of Friends, which will end its contract with Netflix in 2020. In addition to the popular series, WarnerMedia is also trying to put together a Friend’s reunion, but this may be hampered by contract disputes.

HBO Max will also have classic comedies like Fresh Prince of Bel Air and will be the exclusive service to stream hits The Big Bang Theory and South Park.

Of course, HBO Max will have the entire library of HBO’s original series, including Veep and the Larry Sanders Show. J.J. Abrams has signed on to produce original content

Access to a wide range of Warner Bros. produced films and library of TV content.

< BACK TO INSIGHTS